Why sell your mutual funds when you can take a loan against them.

Emergencies never come planned. And when they come they disturb the whole financial plan of household. Usually whenever there is a financial emergency, mutual fund investments are the first source or target for redemption for meeting the financial emergency. But in this process, long term financial goals of the investors are compromised.

Usually such requirement of funds is temporary and can be met taking loans. But taking personal loan is quite a hassle and also very costly that prompts the investor to redeem his investments even at the cost of compromising financial future.

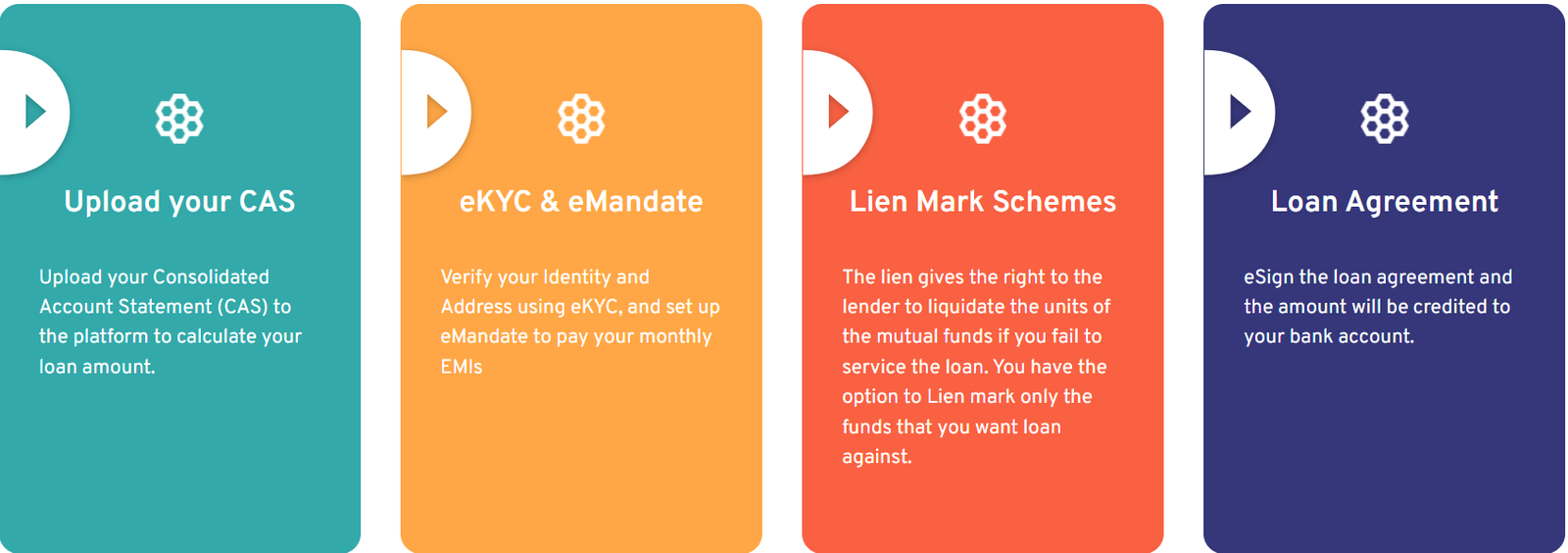

Loan against mutual funds provides a solution to these issues. One can take a loan against his mutual fund holdings in few easy steps online within hours at very low interest rates. He can pay the loan in easy EMIs or can opt to pay interest through EMIs and principal as onetime payment at the time of maturity.

Benefits of loan against mutual funds –

- Investor wealth continues to grow during loan tenure

- Low cost – interest rate stating 10%p.a.

- High Convenience – totally digital process, No physical paperwork

- No capital gain or exit load implication

- Transparent – investor get log in to track all repayments and outstanding amounts

- Facility to pay full amount through EMIs or only interest during the tenure

- Overdraft facility available

Process Flow