“There are only two things you can invest – Time & Money. Of the two – Time is more important.” – Robert Kiyosaki

Beautiful story of an airbus & a fighter plane I came across today that immediately struck my mind, how similar is this to two traits of investing. Let me tell you the story first:

Airbus & the Fighter Plane: An Airbus 380 was on it’s way across to its destination. It was flying consistently at 800 km/hr at 30,000 feet, when suddenly a Eurofighter with Tempo Mach 2 appeared.

The pilot of the fighter jet slowed down, flying alongside the Airbus and greeted the pilot of the passenger plane by radio: “Airbus, boring flight isn’t it?

Now have a look here!

He rolls his jet on its back, accelerates, breaks through the sound barrier, rises rapidly to a dizzying height and then swoops down almost to sea level in a breathtaking dive. He loops back next to the Airbus and asked, “Well, how was that?”

The Airbus pilot answered: “Very impressive, but now you look!”

The jet pilot watches the Airbus, but nothing happened. It continued to fly stubbornly straight, with the same speed. After 15 minutes, the Airbus pilot radios, “Well, how was that?”

Confused, the jet pilot asks, “What did you do?”

The Airbus pilot laughs and says, “I got up, stretched my legs, walked to the back of the aircraft to use the bathroom, then got a cup of coffee and a chocolate fudge pastry.

Stock Market Investing: Very often we come across many young fighter pilots of stock markets who trade in stocks based on their usually (mis)understood market study or the technicals. They regularly buy and sell stocks basis the signal they receive from their study and during bull markets they make decent returns.

Every day they have to spend lot of time studying the market data, economy and political/social events that might have bearing on the markets next day.

Opposite to them are airbus pilot kind of investors. They invest for long term into carefully selected investment products often through mutual funds and then they relax.

They are not bothered by what FII/DII bought or sold today or how foreign markets are doing or where crude prices are heading or open interest in derivative markets etc. Once in six months or a year they review their portfolio with their advisors and see if they need to make any changes or continue with the same investments.

This second airbus pilot kind of investors remain relaxed & poised without being perturbed by market fluctuations and make the best returns on their investments. Investors like Warren Buffet or Rakesh Jhunjhunwala represents this class of investors.

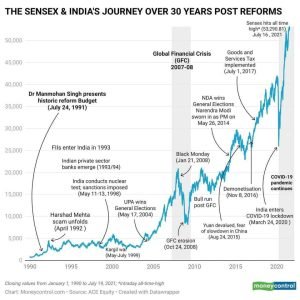

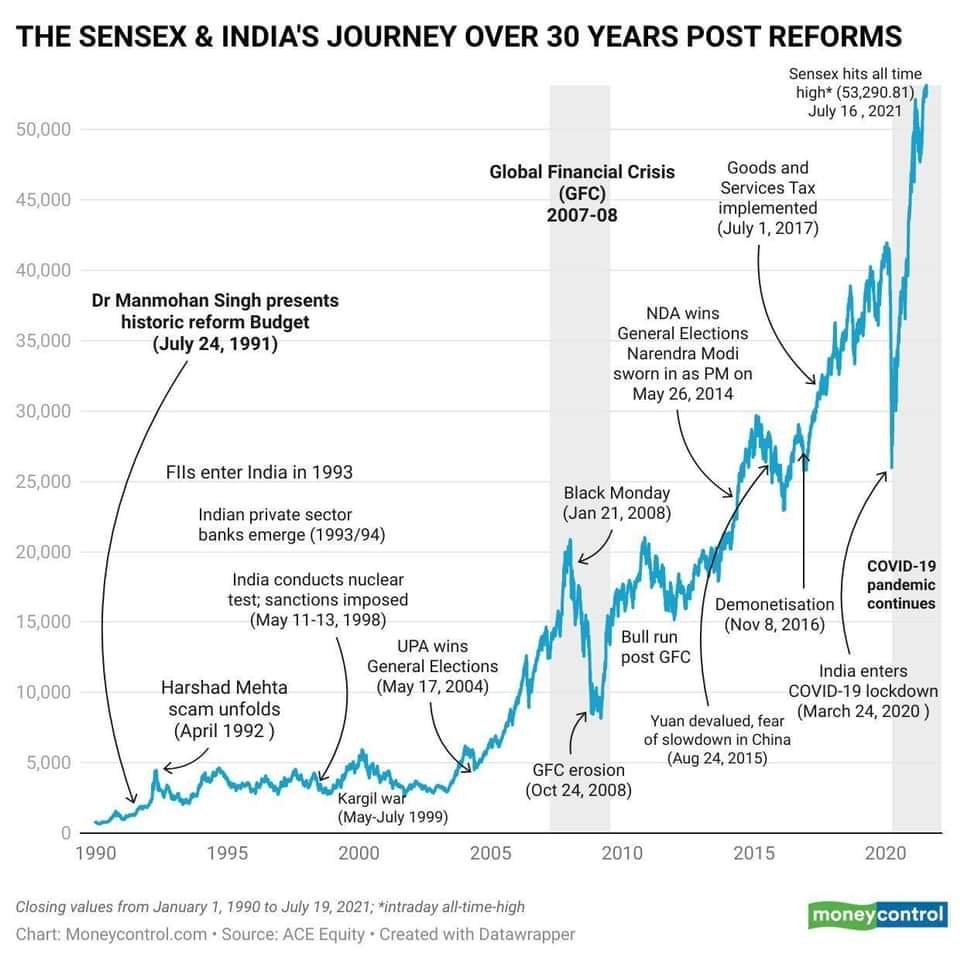

A casual look at the following chart of Sensex journey vis-à-vis economic events, will tell you how good it is to invest and relax than to get involved in trying to time the markets losing your peace. Sensex rose from 1,000 in July 1990 to over 53,000 over a couple of days back.

Moral of the story: When you are young, speed and adrenaline seems to be great. But as you get older and wiser you learn that comfort and peace are more important. Similarly chasing and trying to time the markets may initially enthuse you but with the time you spend, you get to learn it is better to invest and relax.

For all your investment queries or review of existing investment and insurance policies, you may whatsapp/write to us at 📱 9958447700 / 9254673750 or 📧 info@investmentmitra.com

Thank you.

Happy Investing!

Team InvestmentMitra