Few years back, we have talked about Indian’s ability to adapt to any situation. Same is reflected the way Indian government & corporates have managed the situation from first lock down to second phase of lock down. Despite the health bedlams during second wave of corona and unprecedented number of fatalities that forced the second lock down, Indian economy kept moving. Increase in tax collection, power consumption, capacity utilization, consumer spending, employment numbers etc. confirms the uptrend and revival in the economy.

Stock markets anticipates the future and its trends reflect the same most of the time. With improved sentiments and well supported by ample liquidity it has seen an unprecedented rally over last year. And this rally has spread well across all market segments. Though market valuations are high at this point of time when compared to long term averages but with earnings fast catching up, these valuations are coming back to normal.

For those who have to invest for long term but are wary of high valuations, balance advantage or dynamic asset allocation funds provide a good option. Another good option has come in the form of “New Fund Offers” or NFO. Fund managers of new schemes has the liberty to invest the money collected over period of time that may span over one year. Fund managers of existing schemes don’t have this privilege.

Also please note that all NFOs may not be worth your investment. For this you have to check the investment mandate & philosophy of the proposed scheme, fund house & its manager’s background, performance of the funds being managed the proposed fund management team etc.

Smallcap Stocks: Smallcaps are the companies that have market capitalization of less than 250th listed companies as declared by AMFI. Series of lock-downs affected such businesses the most. But with government undertaking many measures to support them including production linked incentive programs & its focus on infrastructure development have helped economy pick up well.

Lower taxation, lower interest rates, PLI incentives & other concessions by government and lower operational costs have helped small companies improve their balance sheets. Industry consolidation is also playing significant role as most small cap companies competes with unorganised sectors. And all this reflected in smallcap shares making strong comeback in stock markets.

PGIM Small Cap Fund – This scheme will predominantly invest in shares of smallcap companies aiming for long term capital appreciation. It will follow combination of top down and bottom up investment strategy to pick up stocks and construct its portfolio with focus on fundamentals of each stock. It may also consider investing in large or midcap companies or even overseas companies.

Usually small cap companies are under owned and less researched and tracked. They face survival risk during economic downturn. They also have liquidity risk as number of shares available for trading are very less. But then these are the companies that have potential to generate high alpha over large & midcaps in the long term.

We suggest investors with high risk appetite and having minimum investment horizon of over 5-7 years should take a plunge into such funds. And investment in this along with other small cap funds should not be more than 20% of your overall portfolio.

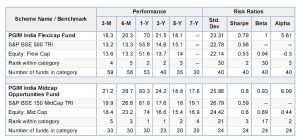

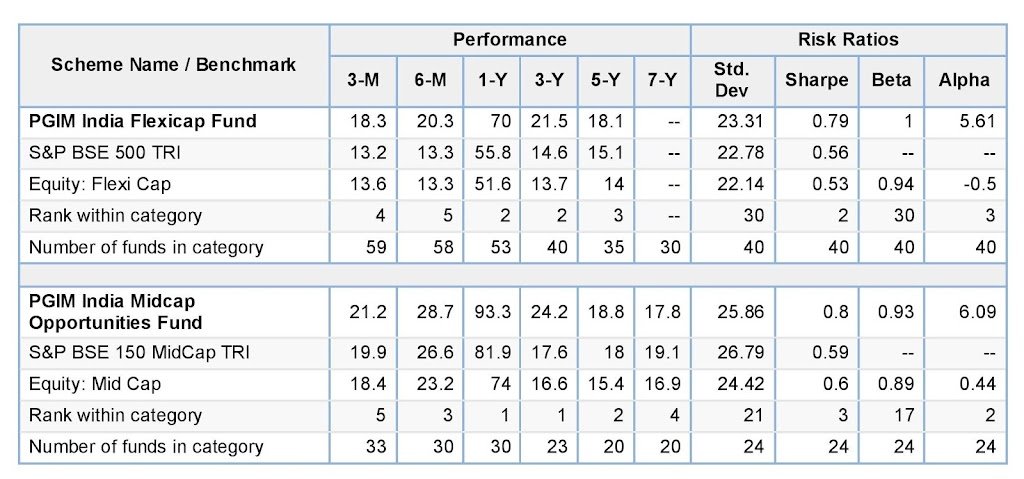

Fund Managers – This fund will be managed by Mr Anirudha Naha who is also managing PGIM Flexicap Fund and PGIM Midcap Opportunities Fund along with K Ramakrishnan & Ravi Adukia. Two funds managed by Mr Naha are among the top five schemes in their respective categories across time periods and have very low volatility measured by standard deviation and beta when compared with benchmark and their categories. Thus giving higher risk adjusted returns to its investors.

Team InvestmentMitra